Sadc milk output tops 3,3 billion litres

- By Zimpapers Syndication |

- 07 Jan, 2026 |

- 7

Sifelani Tsiko

Milk production in southern Africa rose to 3,3 billion litres in 2015 with an estimated value of nearly US$1,4 billion (using average wholesale price of US$0.43 per litre) amid growing concern about the influx of imported dairy products which are hurting local business.

Figures gleaned from media reports, journals, UN agency reports and various milk producers association updates in 10 Sadc member states all indicate that although milk production has been increasing over the years, demand has also increased and the gap between these two is widening up within the Sadc region.

Dairy industry analysts say due to population growth and increase in per capita consumption, demand for milk is expected to increase, even more, in the future years in the entire southern Africa region.

“Increasing milk production to satisfy demand is therefore a challenge to Southern African dairy systems,” said Mr Emmanuel Zimbandu, national chairman of the Zimbabwe Association of Dairy Farmers told the Southern Times during a tour successful dairy farms in Marirangwe in Mhondoro district, about 50km south of the capital, Harare.

“Zimbabwe’s milk production levels are growing but we can’t be compared to South Africa. We are quite positive about growth and demand for milk within the region is growing. This gives us much hope about the future of the dairy industry here in Zimbabwe and elsewhere in the region.”

The bulk of the 3,3 billion litre figure for Sadc comes from South Africa, the region and the continent’s biggest economy.

Figures from Milk SA show that unprocessed milk from producers rose 5,5 percent to 3,1 billion litres in 2015 from a year earlier.

In South Africa, some 600 000 dairy cows produce more than 3 billion litres of milk which is consumed locally while the other significant portion is exported.

Figures from other Sadc countries show that Zambia produced 75 million litres, Zimbabwe (57,5 million litres), Swaziland (8,4 million), Tanzania (50 million), Namibia (23 million), Botswana (4 million), Mauritius (6,5 million), Mozambique (2,1 million) and Madagascar (530 000).

The total figure excludes Angola, DRC, Lesotho, Malawi and Seychelles.

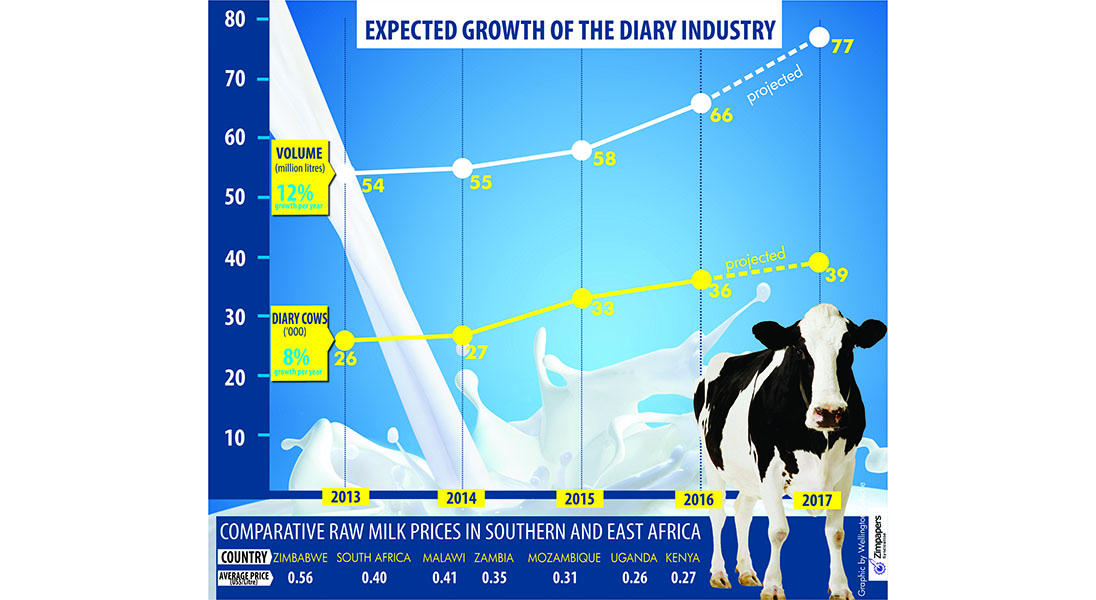

Milk production in Zimbabwe continues to grow and the latest figures show that total production of milk in 2015 rose by four percent to 57,5 million litres compared with 55,5 recorded in 2014.

Production in 2016 also started well and the ZADF says about 5,52 million litres were produced in January, 18 percent than the comparable period last year.

Production levels vary in the region and most other countries still have weak data and information collection systems that makes it very difficult to make credible comparison in terms of milk production levels within the Sadc region.

For example, Tanzania is the second largest livestock keeper in Africa after Ethiopia with an estimated 52 million cattle, 36 million sheep, 35 million goats and 5 million camels.

Tanzania has 21 million cattle, 6 million sheep and 15 million goats according to 2011 estimates.

Total milk production in Tanzania is estimated at 2.06 billion litres per year according to a 2015 survey commissioned by the East Africa Dairy Development (EADD) Project II.

However, the Tanzania Milk Processors Association (Tampa) said out of the 2 billion litres produced per year, only 50 million litres are processed and marketed locally.

Dairy experts in Tanzania say 70 percent of the milk is produced from traditional cattle – a system with larger cattle numbers, small herd sizes, low animal productivity and greater dependency on family labour and the informal market.

This, they say, makes it difficult to obtain enough milk and to collect data which could be useful for planning purposes.

“What makes local processors fail to process enough milk is that cows are scattered and it is therefore difficult to collect enough milk at a time,” a dairy official was quoted saying in the media.

Kenya, South Africa, Zimbabwe, Botswana and Namibia have concentrated zones of production which makes it easy to access data and information about milk production.

Some dairy experts say Sadc countries have a huge potential to increase dairy production and productivity if the region’s dairy farmers develop strategies to promote access to markets, dairy breeding stock, improve dairy technologies and efficient advisory and business development services in areas such as animal health, feeds, finance, markets and marketing infrastructure.

They also add that Sadc countries need to train producers and market agents on hygienic milk production and handling, facilitate acquisition of appropriate milk handling equipment and link producer marketing organisations to reliable markets.

Drought and climate change have had an adverse effect on the dairy industry within the Sadc region.

In South Africa and in most other Sadc countries such as Zimbabwe, Botswana and Namibia, milk farmers are scaling back output as lower prices and higher feed costs render some production unprofitable.

Grazing shortages have worsened the situation owing to the El Nino induced drought which is ravaging the entire southern Africa region.

The Milk Producers Organisation (MPO) of South Africa says a decrease in producer prices in 2015 and the sharp increase in grain prices, the extreme hot and dry conditions and the current and projected scarcity of roughage have led to a decline in milk production.

MPO further projects milk production decline in the coming months as a result of drought.

Drought fueled the price of stock feeds and eroded producers’ margins.

Figures released by the Dairy Farmers Association of Zambia show that 75 million of milk were produced in 2015 up from 65 million litres in the 2013/2014 season.

Zambia’s figure still falls far short of the national demand of 455 million litres per annum.

Botswana is still faced with a deficit in milk production as last year (2015) only four million litres were produced against the national demand of 65 million litres of milk per annum.

The country is currently heavily dependent on imports for milk and related products with about 95 percent of the national demand being met by supply from outside the country which the Governments attributed to lack of infrastructure, shortage of quality feeds, low farm gate price as well as lack of appropriate funding to support the sector.

Zimbabwe which has a processing capacity in excess of 400 million litres, has an estimated demand of 240 million litres per annum which far exceeds the current supply of just over 50 million litres.

The East and Southern Africa Dairy Association (ESADA) says the country has potential to increase milk production to 120 - 140 million litres annually and an opportunity for exporting an additional 2 million litres per month, if it addresses challenges facing the sector.

According to research by the International Farm Comparison Network (IFCN), Zimbabwe has the world’s highest cost for doing dairy – US$59,50 per 100kg of milk while the global average is less than US4o per 100kg.

ZADF says it cost between US$0,46 and US$0,64 to produce a litre of milk in Zimbabwe.

Swaziland’s annual demand for milk and milk products is estimated to be around 56 million litres per year, whereas milk production from the national dairy herd is around 8,4 million litres, leaving a shortage of about 47,6 million litres, according to official figures.

Major constraints in Swaziland include stockholding capacity, weak cooperative societies in the dairy sector, poor packaging which result in low quality milk and inadequate flow of finance across the different segments of the dairy value chain.

Mozambique produces an estimated 2,1 million litres a year, about 20 percent of consumption forcing the country to import more than 8 million litres to cover the demand gap.

Namibia produces 23 million litres of milk annually and dairy farmers in that country are concerned about the influx of cheap South African milk products which they say are hurting their business.

Local dairy producers say the use of synthetic hormones that induce milk production in South Africa, low transport cost through, which supplies of milk ordered from South Africa are subjected to the same transport costs per truck delivery, VAT exemption for SA milk have contributed to the inability of the dairy industry in Namibia to effectively compete with the South African dairy industry.

Angola spends over US$150 million each year on milk imports and the country consumes around 180 million litres of milk per year.

Its milk production is almost exclusively focused on transforming powdered milk into pasteurized milk as there are few dairy cows in the country.

The production of milk in Mauritius has increased by 97 percent since 2008 from 3,3 million liters to 6,5 million litres of milk in 2015.

Madagascar produces about 530 000 litres of milk a year against a national demand of 100 000 million litres.

Most dairy farmers in the region complain that the influx of cheap and low-priced imports of subsidised milk products is a huge challenge

“We’re often threatened with dumping. Tax comparisons put us at a huge disadvantage over other exporting countries, who receive tax export incentives and tax relief,” says a South African dairy industry representative.

“We need a tariff-levelling system, including tax policies, to level the playing field, and incentivise growth through exports.”

In the last three decades, world milk production has increased by more than 50 percent, from 482 million tonnes in 1982 to 802 million tonnes in 2014.

Total cow milk production in Africa was 21 million tonnes in 2014, produced from a total of 46 million dairy cows giving an average milk yield of 461kg milk per cow over the year, which is only one fifth of world average yield, according to the UN FAO figures.

The top five African milk producing countries in terms of milk volume are Sudan, Egypt, Kenya, South Africa and Algeria.

The farm animal resources of SADC are rich and immensely diverse. The livestock population in SADC is estimated at 64 million cattle, 39 million sheep, 38 million goats, 7 million pigs, 1 million equines and 380 million poultry. An estimated 75 percent out of the above livestock population is kept under smallholder traditional systems.

No Comments

Comment